In today’s post, we will delve into the intricacies of the Supplemental Nutrition Assistance Program (SNAP) eligibility requirements. Understanding these criteria is crucial for those seeking assistance with food security and nutrition. By gaining insight into the qualifications and application process for SNAP benefits, individuals and families can better navigate the system to access the support they need. Join us as we explore the eligibility requirements for SNAP and empower ourselves with knowledge to help those in our communities facing food insecurity.

Income Guidelines for SNAP Eligibility

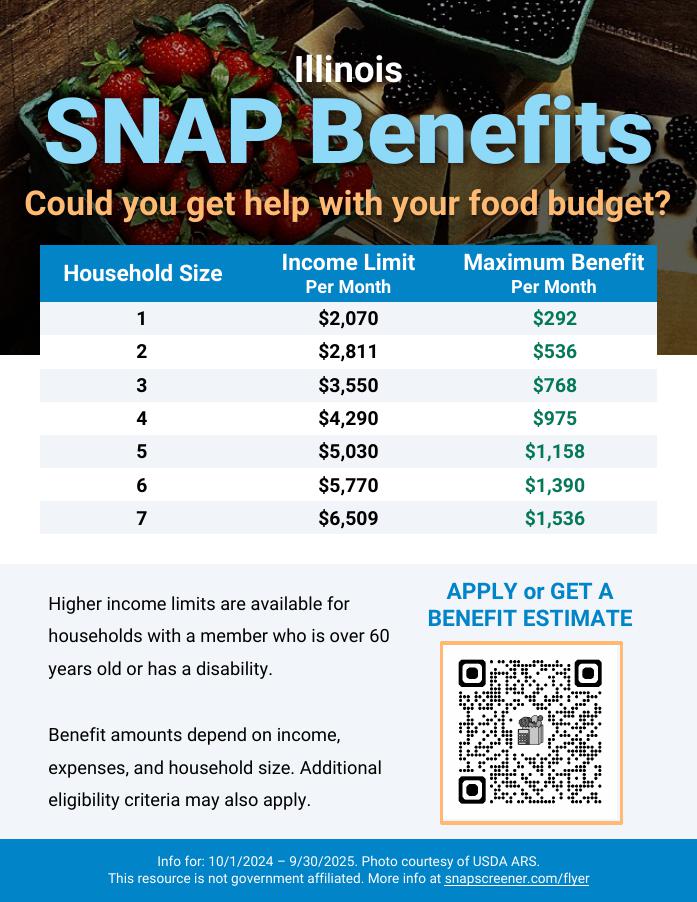

Understanding the income guidelines for SNAP eligibility is crucial for individuals and families in need of assistance. The income limits set by the program determine who qualifies for benefits based on their financial situation. It is important to note that income includes not only wages but also other sources such as child support, pensions, and unemployment benefits. Being aware of these guidelines can help applicants determine if they meet the financial criteria to receive SNAP benefits.

Qualifying Income Levels

Qualifying for SNAP benefits depends on meeting the income thresholds established by the program. Individuals or households with incomes below the federal poverty level are typically eligible for assistance. It is essential for applicants to accurately report their income to determine if they fall within the acceptable range. Understanding what countable income includes and excludes can ensure that applicants provide the correct information for their eligibility assessment.

Assets and Resources Considered for SNAP Eligibility

Understanding the assets and resources considered for SNAP eligibility is crucial for individuals and families seeking assistance. When determining eligibility for the Supplemental Nutrition Assistance Program (SNAP), it’s essential to take into account various factors beyond just income. Assets such as savings accounts, investments, and property ownership can impact eligibility and benefit amounts. It’s important to be aware of how these assets are evaluated to ensure accurate determination of eligibility.

Income Guidelines for SNAP Eligibility

Income guidelines play a significant role in determining SNAP eligibility. In addition to assets, income levels are used to assess an individual or household’s financial need. It’s essential to understand the current income thresholds set by the program to determine eligibility. Ensuring that income falls within the specified guidelines is crucial for receiving SNAP benefits.

Household Composition and SNAP Eligibility

Understanding household composition is essential when determining eligibility for SNAP benefits. It refers to the individuals who live and eat together as a single economic unit. In households with multiple members, each person’s income and expenses are considered when assessing eligibility. For example, a family of four will be evaluated differently than a single individual. The number of people in a household can impact the amount of benefits received, as larger households may have higher expenses.

Additionally, the relationship between household members is crucial in determining eligibility. For instance, children under a certain age may be eligible for separate benefits, while adults in the household may be evaluated based on their individual circumstances. Understanding the dynamics of the household, including who contributes to the income and expenses, helps ensure that SNAP benefits are allocated appropriately to those in need.

Citizenship and Immigration Status Requirements for SNAP

Understanding the citizenship and immigration status requirements for SNAP is crucial for individuals seeking assistance. To be eligible for SNAP benefits, applicants must meet certain citizenship and immigration status criteria. Generally, U.S. citizens and certain qualified non-citizens are eligible for SNAP benefits. Qualified non-citizens include lawful permanent residents, refugees, asylees, and individuals granted withholding of deportation.

Citizenship Requirements

U.S. citizens are automatically eligible for SNAP benefits upon meeting other program requirements. They must provide proof of citizenship, such as a birth certificate or passport, during the application process. For qualified non-citizens, they must meet specific criteria to be eligible for SNAP. These criteria may vary based on the type of non-citizen status, and individuals may be required to provide documentation to verify their immigration status.

Applying for SNAP Benefits: Process and Documentation

When it comes to applying for SNAP benefits, the process can sometimes feel overwhelming. However, it’s important to know that there are resources available to help guide you through each step. To begin, you will need to gather important documentation such as proof of income, expenses, and identification for all household members. This information will be crucial in determining your eligibility for SNAP benefits.

Once you have all the necessary documentation, you can start the application process. This can typically be done online, in person at a local SNAP office, or by mail. It’s important to provide accurate and honest information to ensure that your application is processed efficiently. Remember, applying for SNAP benefits is a confidential process, and your privacy is protected throughout.

Snap Benefits Calculation and Distribution

Calculating Snap benefits can be a complex process that takes into account various factors such as income, household size, and expenses. The amount of benefits a household receives is determined by a formula that considers these factors, and it is important to provide accurate information to ensure that the benefits are calculated correctly. Once the benefits are calculated, they are distributed to the household in the form of an Electronic Benefit Transfer (EBT) card, which can be used to purchase eligible food items at authorized retailers.

Understanding Snap Benefit Calculation

When calculating Snap benefits, the program takes into account the household’s gross income, deductions, and other expenses to determine the net income available for purchasing food. The formula used to calculate benefits is designed to ensure that households with lower incomes receive more assistance than those with higher incomes. Additionally, certain expenses, such as housing and utility costs, may be deducted from the household’s income to further adjust the benefit amount.

Distribution of Snap Benefits

Once the Snap benefits are calculated, they are typically distributed to the household on a monthly basis. The benefits are loaded onto the EBT card, which works like a debit card and can be used at authorized retailers to purchase eligible food items. It is important for recipients to budget their benefits carefully throughout the month to ensure that they have enough to cover their food expenses until the next distribution date.